If you are looking for best small cap stocks to invest in October 2022. If you can sustain volatility in stocks, small cap stocks are best investment option for you.

What is small cap stocks.

Small cap stocks are stocks of companies having market capitalization from $300 million to $2 billion. Small cap companies stock prices has very high volatility. During bull run of market small cap stocks outperform major benchmark market indexes and during bear run they underperform the market.

Small cap companies has very less cash flow. Due to which during inflation and recession, make it difficult for sales growth of company. Stock fails market expectation and lead to deep correction.

Parameters to analyse small cap stocks

(1) Top Management Attitude.

The attitude of top management, CEO and CFO of small cap company is very important. There vision and road map to projection of growth is very important. Some times it is seen the promoter is either not well involved into business. Also in many business it is seen even though the company is not making free cash flow or money for share holders. Where as the promoter wealth is growing. That is why one has to read the CEO message in annual reports very carefully.

(2) Sales Growth.

Small cap companies has very less operating fund in hand to meet operating expense. They can grow there business by reinvesting the profit into the business. Companies focusing on sales growth and expansion by reinvesting their profit into business are good companies to invest into. The small cap companies distributing good dividend is not good to invest in our view. Major share holder is the promoter hence divided distributed mainly is money paid to promotor. Instead small cap company can become big by reinvesting profits into business.

(3) High Operating Margins.

Companies which can generate cash flow for there own business can generate money for stock holders. Companies which disrupt the existing style of business and solution to problem people looking for can demand very high margins. Higher the operating margin, lesser difficulty in managing his operating expanse and higher growth prospect.

Advantages of investing in small cap stocks.

(1) High percentage growth potential.

Investing into a stock when it is small will give enormous growth opportunity to investors. All large cap or mage cap companies where small when the just listed on stock market, like Apple Inc. and Microsoft. The small cap companies can grow multifold more easily as compare to large cap and mage cap. Small cap companies give multifold return with the growth of company.

(2) Good investment opportunity for retail investors.

Many institutional investors, fund house and hedge funds do not invest into very high volatile stocks. Hence they keep very small proportion of investment into small cap companies. Hence small cap stocks are good investment opportunities for retail investors to become share holder of tomorrow’s large cap companies. Small cap stocks are real wealth creation opportunity for retail investors.

Three good small cap stocks.

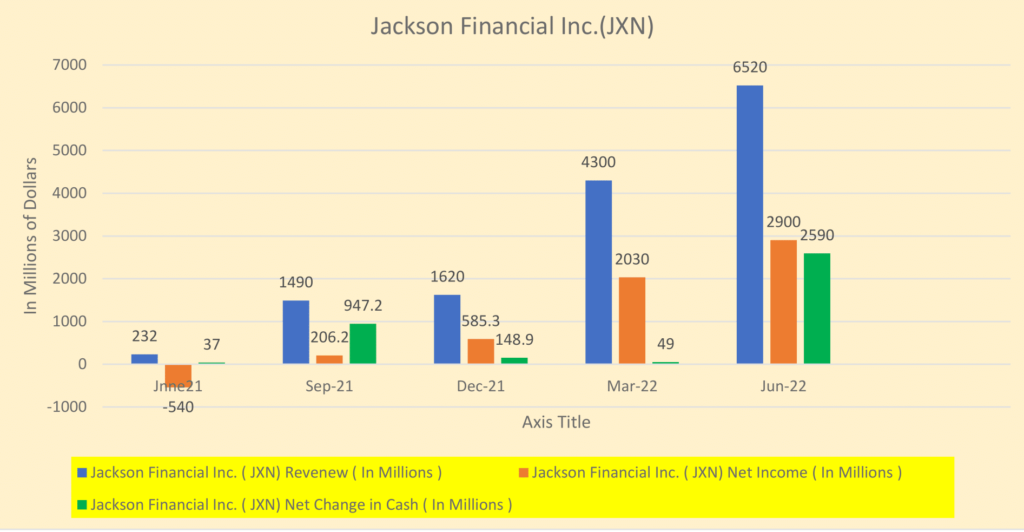

(1) Jackson Financial Inc. ( JXN )

Jackson Financial Inc. is a service provider for long term retirement fund development. Stock price $34.48 ( 24 October 2022 )

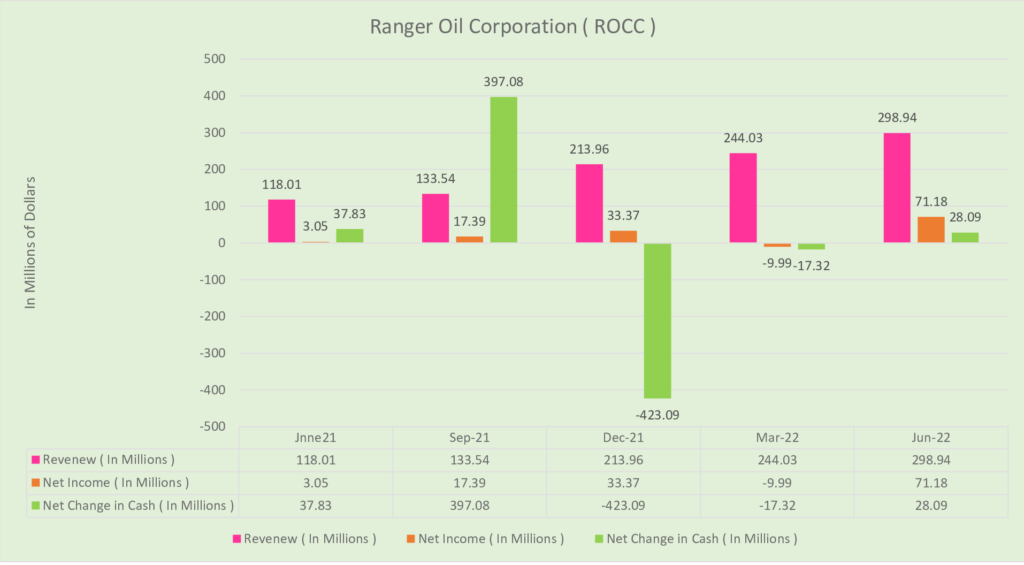

(2) Ranger Oil Corporation ( ROCC ).

Ranger oil corporation is independent oil and gas exploration and production of Natural Gas in different regions of united states. Share price is $39.32 (24/10/2022 )

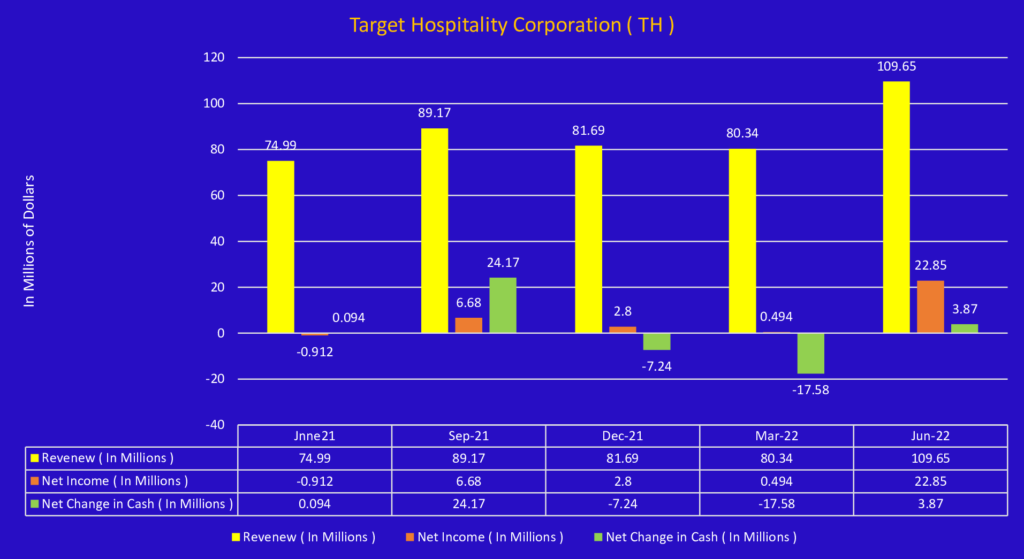

(3) Target Hospitality Corporation ( TH ).

Target Hospitality based at The Woodlands, Texas and some more locations at United States. Target Hospitality is a company that provide lodging and temporary housing solutions for workforce. Share price $11.49 ( 25/10/2022 )

Conclusion

Small cap stock investment is very risky investment. Every investor has to do lot of research before investing. Small cap stocks are very volatile stocks. They outperform the major benchmark during the bull run of market. The small cap stock underperform during the bear run. Investor has to be very active and should at most active if investing in small cap stocks.